It's that time of year again...Tax Time! Are you one who waits til the last minute to get your tax papers in order? Do you stress about finding all your receipts? Do you vow to do better next year?

I'm here to offer a few tips on how I keep everything organized throughout the year so taxes are a breeze come the first of the year.

I can't help you much with your 2011 taxes, but but I can help you can get your 2012 taxes organized NOW!

~~~~~~~~~~~~~~~~~~~~~~~~~

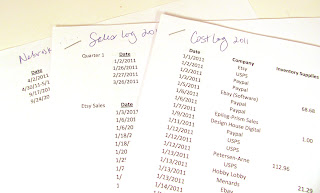

I find it best to break taxes into manageable time lines. There are things I enter immediately, things I enter monthly and things I enter quarterly. I use Excel to organize everything, but there are several other ways you can do this. Do what works for you.

Immediate Entries

I have started to enter my local sales on the day I get paid for them. I tend to forget about them if I don't enter them right away.

Monthly Entries

*Each month I print out my Paypal statement and enter the data in the correct column of my Cost Log. You could also copy and paste the data from the CSV download as well. I'm a visual person and like to write notes on my statement, so I print mine out.

*I also keep all of my receipts from the month in a baggie and enter those monthly as well.

*Just this year, I've started keeping a monthly Profit Log. It details what items sold, how much the materials cost, Paypal fees and Etsy fees. It doesn't take into consideration when I buy things in bulk or any other overhead. I just wanted an item by item profit log to see how I'm doing.

Quarterly Entries

I pay my state sales tax quarterly, so I update my Sales Log quarterly as well. My locals sales are already entered, but I transfer my data from Etsy and enter my consignment sales as well. I break my Sales Log into sections so I know which sales I collected taxes on and which ones I didn't. Then I make sure to note why taxes were not collected on these sales (wholesale, out of state, etc.)

Keep in mind that you can do things differently and still stay organized. You can enter your sales monthly if you like and enter your Paypal data weekly, etc. Do what works for YOU. But make sure you do it!

~~~~~~~~~~~~~~~~~~~~~~~~~~~

Have any good tax tips? Share them with us in the comments!

.jpg)