It's that time of year again...Tax Time! Are you one who waits til the last minute to get your tax papers in order? Do you stress about finding all your receipts? Do you vow to do better next year?

I'm here to offer a few tips on how I keep everything organized throughout the year so taxes are a breeze come the first of the year.

I can't help you much with your 2011 taxes, but but I can help you can get your 2012 taxes organized NOW!

~~~~~~~~~~~~~~~~~~~~~~~~~

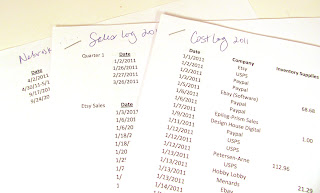

I find it best to break taxes into manageable time lines. There are things I enter immediately, things I enter monthly and things I enter quarterly. I use Excel to organize everything, but there are several other ways you can do this. Do what works for you.

Immediate Entries

I have started to enter my local sales on the day I get paid for them. I tend to forget about them if I don't enter them right away.

Monthly Entries

*Each month I print out my Paypal statement and enter the data in the correct column of my Cost Log. You could also copy and paste the data from the CSV download as well. I'm a visual person and like to write notes on my statement, so I print mine out.

*I also keep all of my receipts from the month in a baggie and enter those monthly as well.

*Just this year, I've started keeping a monthly Profit Log. It details what items sold, how much the materials cost, Paypal fees and Etsy fees. It doesn't take into consideration when I buy things in bulk or any other overhead. I just wanted an item by item profit log to see how I'm doing.

Quarterly Entries

I pay my state sales tax quarterly, so I update my Sales Log quarterly as well. My locals sales are already entered, but I transfer my data from Etsy and enter my consignment sales as well. I break my Sales Log into sections so I know which sales I collected taxes on and which ones I didn't. Then I make sure to note why taxes were not collected on these sales (wholesale, out of state, etc.)

Keep in mind that you can do things differently and still stay organized. You can enter your sales monthly if you like and enter your Paypal data weekly, etc. Do what works for YOU. But make sure you do it!

~~~~~~~~~~~~~~~~~~~~~~~~~~~

Have any good tax tips? Share them with us in the comments!

.jpg)

.jpg)

We're due in March. I believe I have everything in order.

ReplyDeleteAs your business grows it might be a good idea to purchase tax software.

Excellent suggestions Edi. I have trouble keeping up with entering the invoices as they come in. Last year I promised to do better, but ended up trying to catch up again this year.

ReplyDeleteYou're so detailed and organized! I'm terrible about keeping track of stuff as is happens. You'll usually find me scrambling around the week my quarterly taxes are due. This actually reminds me that I need to go through my big pile of receipts for my income taxes... Booooo...

ReplyDeleteThanks!

ReplyDeleteI used a form I created last year. It would be helpful if it did the addition for me.

Love your idea of breaking things down into daily and monthly and quarterly tasks. TFS

Wow...some great tips. You seem to have it all organized! While getting things in line for my taxes I figured out a good system for my own expenses vs. sales. It's sort of a simplified version of yours- I don't have quite so many sales to record, so it's easy enough for me to just enter them as they come in.

ReplyDeleteEdi - great post and timely as we're all going through it.

ReplyDeleteI use Quicken to keep track of my business. I also have a jewelry software program that keeps track of my inventory - purchases (beads, etc.), finished product and sales. At the end of the year I can cross check the two reports to make sure I haven't forgotten anything.

Great organizational tax tips Edi! Wish my clients were as organized as you are! I would think that by recording the costs of each sale in your Profit Log it's also easy for you to figure out your year end inventory amount. That's a tough one for people since they think everything they buy during the year is deductible and it's not.

ReplyDeleteGreat ideas, and perfect time for a reminder! It is very important to have all your information organized, and easy to pull together at tax time. I am very happy to be all done for 2011!

ReplyDeleteValerie

Everyday Inspired

great to be organized! It's nice to use software, which gives reports. I use Quicken. I printed off medical and education categories for our CPA, which are tax deductible. Waiting for the return now! {:-D

ReplyDeleteYou're very organized! I keep my sales receipts in folders by quarter. If there are sales on which I DO collect sales tax (since most of my sales are out-of-state), I use colored sticky flags to identify them. I guess a visual system must work for me. :-)

ReplyDelete